The finance sector is a dynamic and challenging arena, requiring more than just a basic grasp of numbers and economics. It’s a field that demands a unique blend of skills, strategies, and a continuous learning mindset. For those aspiring to have success in the field of finance, understanding the breadth of this industry is essential, from the complexities of financial markets to the nuances of personal financial planning.

Introduction

Starting a career in finance or aiming to climb higher in this field involves a multifaceted approach. However, excelling in finance isn’t solely about academic qualifications; it’s also about staying abreast of the latest trends, mastering financial analysis, and developing a keen eye for detail.

In today’s fast-paced financial world, keeping up with global market fluctuations, evolving financial regulations, and emerging technologies is crucial. But beyond these technical skills, the human elements—such as effective communication, ethical integrity, and the ability to build robust professional networks—are equally important.

These skills ensure not just individual success but also contribute to the broader integrity and efficiency of the financial system.

This guide delves into the essential skills and strategies needed to thrive in the competitive world of finance. Whether you’re just starting out or looking to deepen your expertise, these insights will help pave the way for a successful and fulfilling career in this fast-paced and ever-evolving sector.

1. Starting with Education

A solid educational foundation is crucial in finance. A bachelor’s degree in finance not only provides the fundamental knowledge needed but also instills critical thinking and analytical skills. In today’s digital age, pursuing a bachelor in finance online offers flexibility and access to cutting-edge financial theories and practices.

Online programs allow aspiring finance professionals to balance their studies with work or other commitments, ensuring they remain updated with the latest trends and technologies in finance. This approach can be especially beneficial for those transitioning into finance from other career paths or looking to update their skills without pausing their careers.

2. Staying Abreast of Financial Trends

The finance sector is continually evolving with global market fluctuations, emerging technologies, and changing regulatory landscapes. Staying informed about these trends is essential for making sound financial decisions and offering valuable advice.

This means regularly reading industry publications, attending finance seminars and workshops, and engaging in professional forums. Keeping abreast of financial news not only helps in understanding the broader economic environment but also aids in predicting potential market shifts, an ability highly valued by finance professionals.

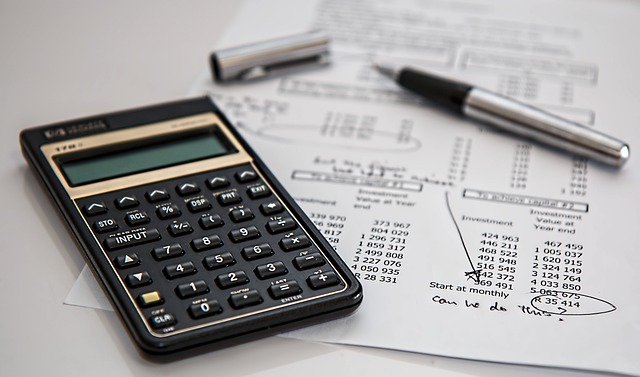

3. Mastering Financial Analysis

Financial analysis is at the heart of the finance sector. It involves interpreting financial data to make business decisions, assess investment opportunities, and forecast future financial scenarios. Proficiency in financial analysis means being able to effectively analyze balance sheets, income statements, and cash flow statements.

This skill is vital for identifying trends, evaluating company performance, and making recommendations for improvement. Mastering financial analysis requires not only a good grasp of financial principles but also an analytical mindset and attention to detail.

4. Developing Strong Quantitative Skills

Finance is a numbers-driven field. Strong quantitative skills are necessary for accurately processing and interpreting data. This includes understanding complex mathematical models and statistical techniques.

These skills are crucial for tasks such as evaluating investment risks, determining market trends, and creating financial forecasts. Professionals in finance often use quantitative analysis to support decision-making and strategy development. Enhancing these skills can involve additional coursework in areas like statistics, algebra, and calculus or practical application through finance-specific scenarios.

5. Effective Communication Skills

Effective communicators can explain complex financial concepts in a way that is easily understood by clients, stakeholders, or team members who may not have a finance background.

This skill is especially important when presenting reports, pitching investment ideas, or explaining financial strategies. Developing strong communication skills can involve practice in public speaking, writing reports, and engaging in negotiations or client meetings.

6. Ethical and Legal Compliance

In finance, adhering to ethical standards and legal regulations is non-negotiable. Professionals must be well-versed in laws governing financial practices and ethical norms. This includes understanding insider trading regulations, anti-money laundering policies, and ethical investment guidelines.

Navigating these complex legal landscapes requires ongoing education and vigilance. Upholding these standards not only protects the professional’s reputation but also maintains the integrity of the financial system. Ethical compliance also extends to personal integrity, such as being transparent in communications and avoiding conflicts of interest.

7. Networking and Relationship Building

Building a broad network of contacts can lead to new opportunities, insights, and partnerships. This involves connecting with peers, mentors, industry leaders, and potential clients.

Attending industry conferences, joining professional associations, and participating in finance-related events are effective ways to expand one’s network. Building relationships is not just about expanding one’s professional circle; it’s also about learning from others’ experiences and staying informed about industry developments.

Strong professional relationships can provide support and advice and open doors to opportunities that might not be available otherwise.

When striving for success in the field of finance, having access to specialized services can be a game-changer. Consider leveraging PortCo services for private equity firms. Quatrro Business Support Services offers tailored solutions to meet the unique needs of private equity firms, providing expertise in areas such as financial analysis, due diligence, and portfolio management. With their comprehensive support, you can enhance your operational efficiency and make informed investment decisions, ultimately maximizing returns for your stakeholders.

8. Technological Proficiency

The finance industry is increasingly driven by technology. From financial modeling software to blockchain and artificial intelligence, technological advancements are reshaping how financial transactions and analyses are conducted. Staying proficient in relevant technologies and software is essential.

This means not only understanding existing tools but also keeping an eye on emerging technologies that could impact the industry. Professionals should seek opportunities to learn about and use new technologies, whether through formal training, online courses, or hands-on experience.

9. Risk Management Skills

Risk management is a critical component of finance. Professionals must be adept at identifying, assessing, and mitigating financial risks. This involves understanding the sources of risk, such as market volatility, credit risk, or operational failures, and developing strategies to minimize their impact.

Strong risk management skills enable finance professionals to make informed decisions and advise clients or their organizations on how to protect assets and investments. Learning about risk management can be achieved through formal education but also through practical experience, such as working on projects that involve risk assessment and mitigation strategies.

10. Developing a Niche Expertise

Specializing in a specific area of finance can set a professional apart from the competition. Whether it’s investment banking, corporate finance, personal financial planning, or another niche, having deep expertise in a particular area can make a professional more valuable and sought after.

This specialization can be developed through additional education, certifications, and practical experience. By focusing on a niche, professionals can become experts in their field, offering specialized knowledge and services that are in high demand.

Conclusion

Success in the field of finance requires a combination of formal education, practical skills, and personal attributes. From adhering to ethical and legal standards to embracing technological advancements, each aspect plays a crucial role in shaping a successful finance professional.

Networking and building relationships are vital for growth and opportunity while specializing in a niche area can provide a competitive edge. Ultimately, continuous learning and adaptability are key to thriving in this dynamic and ever-evolving industry.

By focusing on these essential skills and strategies, finance professionals can navigate their career paths with confidence and achieve lasting success.

Leave a Reply