Consumer lending and credit scoring are two finance areas undergoing significant changes thanks to advances in financial technology or fintech. The use of technology enables the creation of new lending products, new ways of underwriting loans, and better credit scoring models that help identify creditworthy borrowers who have built good credit scores in recent years.

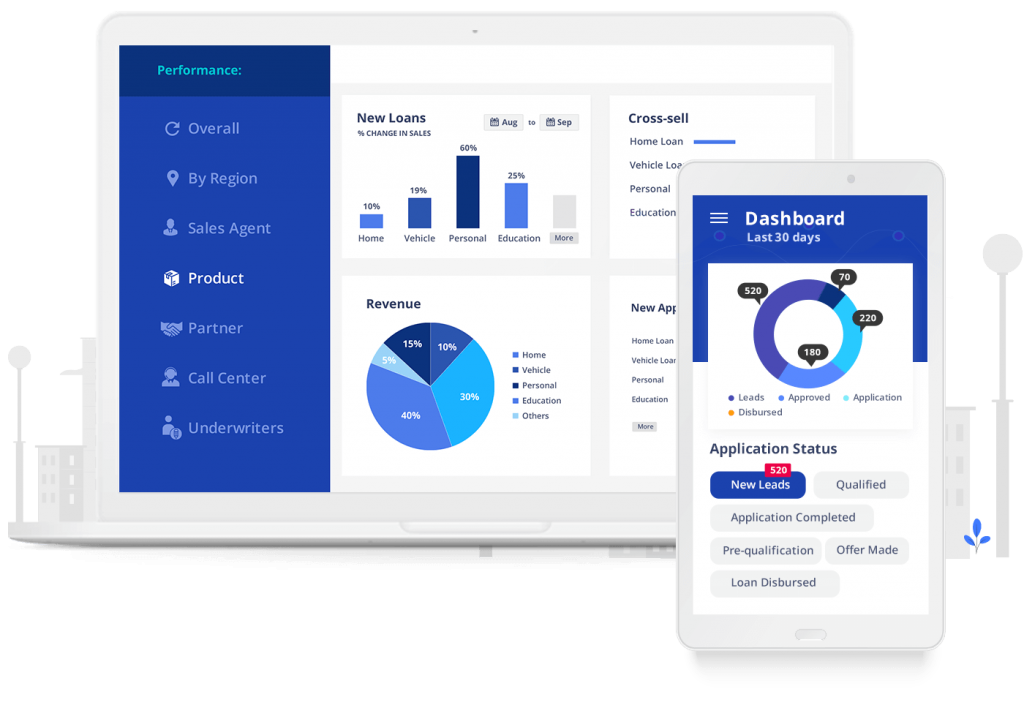

One of the most significant trends in consumer lending is the move toward digital lending platforms. Digital lending platforms are online marketplaces that connect borrowers with lenders, often using algorithms to match borrowers with lenders based on their creditworthiness. Digital lending platforms offer several benefits over traditional lending, including faster processing times, lower costs, and more personalized lending products.

Popular Trends in Consumer Lending

Growth in digital lending solutions is 11% per year, and the market offers a wide range of products to meet different requirements.

Online loan brokers

Marketplace lending, or multi-party lending (MPL), is an alternative to conventional lending. It’s an online venue for investors and potential personal and business borrowers. Convenient application processes allow potential loan recipients to submit requests from the most suitable location.

This is frequently combined with automated onboarding procedures for the user’s convenience.

MLPs use cutting-edge technology to streamline their operations, allowing them to make loans faster than conventional lenders through features like automated underwriting and intelligent decision-making.

Innovative credit risk software allows MLPs to evaluate potential clients who may have difficulty applying for credit through conventional means, such as limited credit history or other factors, but who may benefit from the services offered by MLPs.

Artificial intelligence modules allow MLPs to provide a broader range of lending services and repayment terms based on individual needs and risk analysis rather than fixed rates, satisfying growing market demand.

Social lending / peer-to-peer lending

One of the most talked-about developments in consumer credit has been around for some time. You’ll be able to serve a broader range of customers. This is important because many modern consumers need help gaining access to credit due to a lack of substantial credit history, high debt-to-income ratios, or other similar factors. P2P and other alternative models directly resolve this problem by linking borrowers and lenders. Traditional lenders typically provide interest rates based on appropriate fixed methods, which can result in lower rates for borrowers.

In P2P lending, both the borrower and the lender have more freedom. P2P lending gives lenders more flexibility regarding who they lend to and how they do so, potentially resulting in a more diversified portfolio due to varying risk profiles and investment types.

Digitalization

The use of digital platforms and online lending has increased rapidly in recent years. Consumers can now apply for loans online and receive quick approval and disbursement of funds. The pandemic and the shift towards remote work and e-commerce have accelerated this trend.

Personalized experiences

Consumers are demanding more customized lending experiences. Lenders use data and analytics to understand consumer behavior and preferences and tailor their products and services accordingly. This includes personalized loan terms, repayment schedules, and customer support.

Alternative data

Lenders increasingly use non-traditional data sources like social media and mobile phone usage to assess creditworthiness. This allows them to extend loans to underserved populations who may not have traditional credit histories.

Mobile lending

Mobile lending is becoming more popular, especially in emerging markets with limited access to traditional banking services. Mobile lending allows consumers to access loans and manage their finances using their mobile devices.

Partnership with fintech

Traditional lenders partner with fintech to offer innovative lending solutions. This includes collaboration on digital lending platforms, open banking initiatives, and other financial services.

Fintech in credit scoring

Another trend in consumer lending is using alternative data to assess creditworthiness. Traditional credit scoring models rely primarily on credit history, which can be limiting for borrowers with limited credit histories. Alternative data, such as utility bills, rent payments, and social media activity, can provide a complete picture of a borrower’s creditworthiness.

Artificial intelligence (AI) is another trend in consumer lending. AI algorithms can help analyze vast amounts of data to identify patterns and predict credit risk. Fintech companies are using AI to automate the loan underwriting process, reducing the time and cost of loan origination. AI can also help lenders identify potential fraud and reduce loan defaults.

Trends in Credit Scoring

One of the most significant credit scoring trends is using machine learning algorithms. Machine learning algorithms can help to analyze massive amounts of data to identify patterns and predict creditworthiness. Fintech companies are using machine learning to develop more accurate credit scoring models to help identify creditworthy borrowers who traditional credit scoring models may have overlooked.

Another trend in credit scoring is the use of alternative data. As mentioned earlier, traditional credit scoring models rely primarily on credit history, which can be limiting for borrowers with limited credit histories. Fintech companies use alternative data, such as social media activity, to determine whether people have good credit scores.

The use of open banking is another trend in credit scoring. Open banking is a widespread practice of sharing financial data between banks and third-party providers. Fintech companies use open banking to access data on borrowers’ economic behavior, such as their income and spending habits. This data can be used to create more accurate credit scores and better assess credit risk.

Artificial intelligence (AI) and machine learning

AI and machine learning are being used to analyze large amounts of data and identify patterns that can be used to make lending decisions. Machine learning models help develop credit scoring algorithms that consider broader factors beyond traditional credit scores.

Big data analytics

The explosion of data from digital sources such as social media, mobile devices, and internet searches has created a wealth of information that can be used to build more accurate credit scoring models. Big data analytics are used to understand consumer behavior and preferences better, helping lenders offer more personalized loan products.

Blockchain technology

Utilizing blockchain technology, lending procedures are becoming more transparent and secure.

Smart contracts that automate the lending process can be made using blockchain, lowering costs and boosting efficiency.

Open banking

It enables customers to share their financial information with independent service providers to gain access to better loan products and services.

Lenders can make better lending decisions by using open banking to obtain a complete picture of a consumer’s financial situation.

Alternative credit scoring using AI models

Alternative credit scoring models using AI typically involve machine learning algorithms that are trained on a wide range of data sources, both traditional and non-traditional. The AI model analyzes this data to identify patterns and relationships that can be used to predict a borrower’s creditworthiness.

One example of an AI-based alternative credit scoring model is using social media data. This involves analyzing a borrower’s social media activity, including the frequency and tone of their posts, to identify indicators of creditworthiness. For example, someone who frequently posts about their job and professional accomplishments may be seen as more creditworthy than someone who posts more about partying or other activities that could be seen as less responsible.

Another example of an AI-based alternative credit scoring model is using bank transaction data. This involves analyzing a borrower’s bank transaction history to identify spending patterns and other financial behaviors that can be used to predict creditworthiness. For example, someone who consistently saves a portion of their income and avoids unnecessary expenses may be seen as more creditworthy than someone who spends all their income as soon as it comes in.

AI-based alternative credit scoring models offer several advantages over traditional credit scoring models. They can be more accurate in predicting creditworthiness, especially for borrowers with limited credit histories. They can also be more inclusive, incorporating data from various sources beyond credit reports. However, there are concerns about data privacy and potential biases in the AI algorithms, which must be carefully managed to ensure fair and transparent credit assessments.

Lenders are increasingly turning to alternative credit scoring systems which use artificial intelligence (AI) and machine learning to analyze a borrower’s data from various sources and generate a credit score. These alternative credit scoring systems allow lenders to go beyond fixed credit histories to determine borrowers’ creditworthiness and make more informed lending decisions.

GiniMachine, for example, uses a variety of data sources to generate a credit score, including traditional credit data, bank transaction data, and alternative data such as social media activity and online behavior. The system analyzes this data using advanced machine learning algorithms to identify patterns and trends that can be used to predict a borrower’s likelihood of repaying a loan. This approach can give lenders a more comprehensive view of borrowers’ financial behavior and creditworthiness than traditional credit scoring models.

Using alternative credit scoring systems can also help lenders to reach underserved populations who may not have a traditional credit history or have been excluded from the credit market. By considering a more comprehensive range of data sources, these systems can generate credit scores for people who may have previously been considered too risky for traditional lending.

Conclusion

Consumer lending is evolving rapidly, driven by technology and changing consumer preferences. Lenders who can adapt to these trends and provide innovative solutions will likely succeed in the market.

Overall, alternative credit scoring systems are helping to reshape the lending landscape and make credit more accessible to a broader range of borrowers. However, ensuring these systems are fair, transparent, and unbiased in their assessments is essential to avoid perpetuating existing social and economic inequalities.

About The Author:

Lyle Solomon has extensive legal experience, in-depth knowledge, and experience in consumer finance and writing. He has been a member of the California State Bar since 2003. He graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California, in 1998 and currently works for the Oak View Law Group in California as a principal attorney.

Leave a Reply