Companies lose millions every year to bookkeeping mistakes. In 2020 Citigroup Credit made a clerical mistake, sending close to $1 Billion to Revlon Inc. And while businesses in Honolulu need reliable bookkeeping services, many feel it’s too confusing. The jargon, the abstract concept of money, and the highly complex nature of some of the processes involved are enough to put off even professional accountants!

Bookkeeping gives an accurate picture of your business’ finances and impacts its ability to grow. Read on to find out everything you need to know about bookkeeping to take control of your company’s finances and set yourself up in good stead for the future.

What Is Bookkeeping?

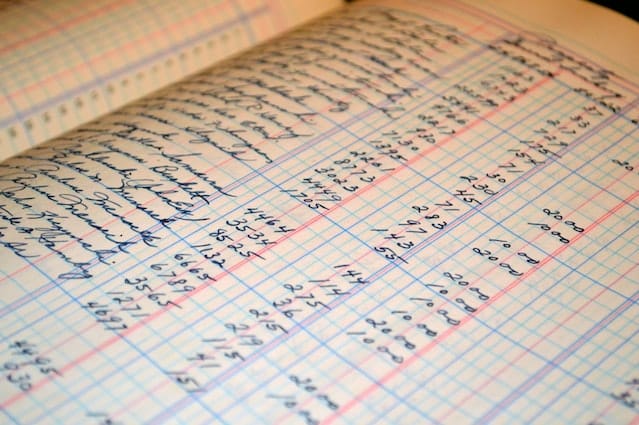

Bookkeeping is the process of recording financial transactions and maintaining records for a business. You can do it manually or through software; it keeps track of all your financial transactions, including income and expenses, so you can see how much money you have coming in and going out.

Bookkeepers are responsible for entering financial transactions into the accounting system, maintaining journals and ledgers, and adjusting the accounts. They may also post transactions to the general ledger, summarizing accounts and preparing reports on the company’s financial position.

Why Does Bookkeeping Matter In a Business?

You can maintain bookkeeping in various formats like cash books, journals, and ledgers, which can prepare financial statements such as profit and loss accounts or balance sheets.

Bookkeeping is essential in any business because it helps you to:

File Tax

If you don’t have a system to keep track of your transactions, then there is no way for you to file your taxes correctly. You need good accounting software to help you keep track of your transactions so that you can file your taxes correctly and avoid penalties from the IRS.

Have Financial Statements

When banks want to lend money, they want their borrowers to provide them with financial statements such as profit and loss statements, balance sheets, and cash flow statements. These documents help them evaluate how much risk they are taking on by lending money to someone else, so if you don’t have these documents prepared, they will unlikely give you any loans!

To Note Errors

It enables you to identify errors before entering data into the system. It prevents false reports from being generated and prevents fraud from occurring within the company.

Keep Track of Tax Deductions

Bookkeepers ensure that all required documentation gets properly filed to receive tax deductions for business expenses. You can also use these records to prepare your tax returns each year.

Manage Your Cash Flow

Access to accurate financial statements allows you to make informed decisions about how much money is coming in versus how much money is going out. It helps you plan for expenses like payroll or equipment purchases.

What Method of Bookkeeping Should You Use for Your Business?

There are different methods of bookkeeping. Depending on your business, you may want to use one method.

The following are some examples of methods of bookkeeping:

- Single entry – You record financial transactions that involve only one journal entry per transaction. Small businesses and sole proprietorships use single-entry bookkeeping.

- Double entry – Double-entry bookkeeping uses two sets of books to record transactions: one for assets and liabilities and another for income and expenses. You record each transaction twice to balance out the accounts involved. It makes it possible to identify errors in accounting more easily because the books are kept separate.

- Cash-basis accounting – You calculate income using only actual receipts and payments. A business using the cash basis would not record income until they receive payment from customers or clients, nor would they record expenses until those expenses get paid.

- Accrual-basis accounting –You calculate income using the date an item is due, regardless of whether it gets paid for. A business using the accrual basis would record income when earned, even if you have not received payment. You can use an accrual basis in banks, insurance companies, other financial institutions, and most corporations and partnerships where the law requires financial statements.

Bookkeeping is a chore, but no one looks forward to it. By reviewing your books regularly and keeping track of your finances, you can ensure that you stay on top of things and solve any potential issues before they become disastrous. Understanding your financial situation is a crucial step in growing your business. And luckily, you can outsource bookkeeping services online to save costs while managing all your money matters.

Leave a Reply