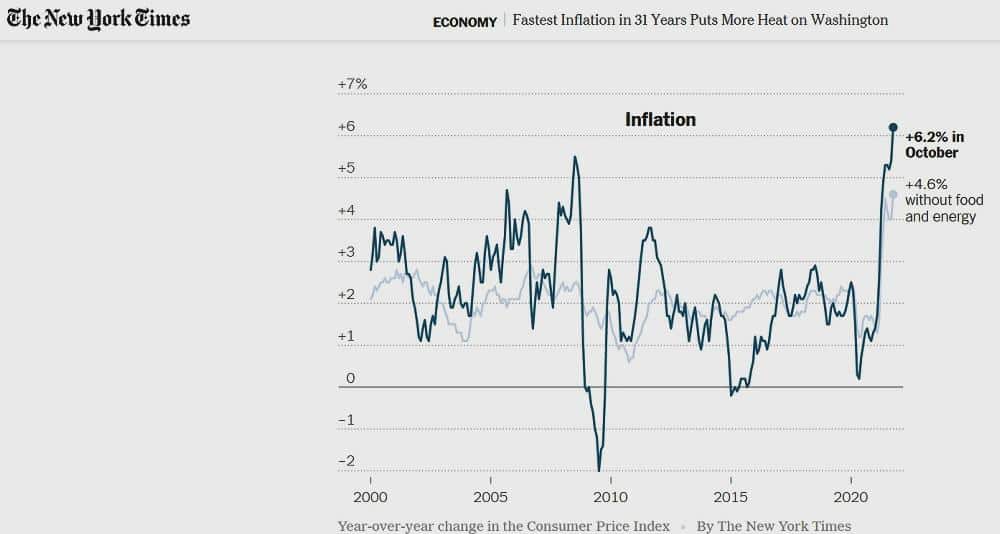

Inflation is going up; the dollar in your pocket is worth less each month. You know the outlook is bad when they start massaging the figures. “Only 4.6%” without food and energy! Like we can do without food and gas!

2021 inflation graph screenshot. Source – New Your Times

Inflation is accelerating, so it looks like we are stuck with it for at least a few years.

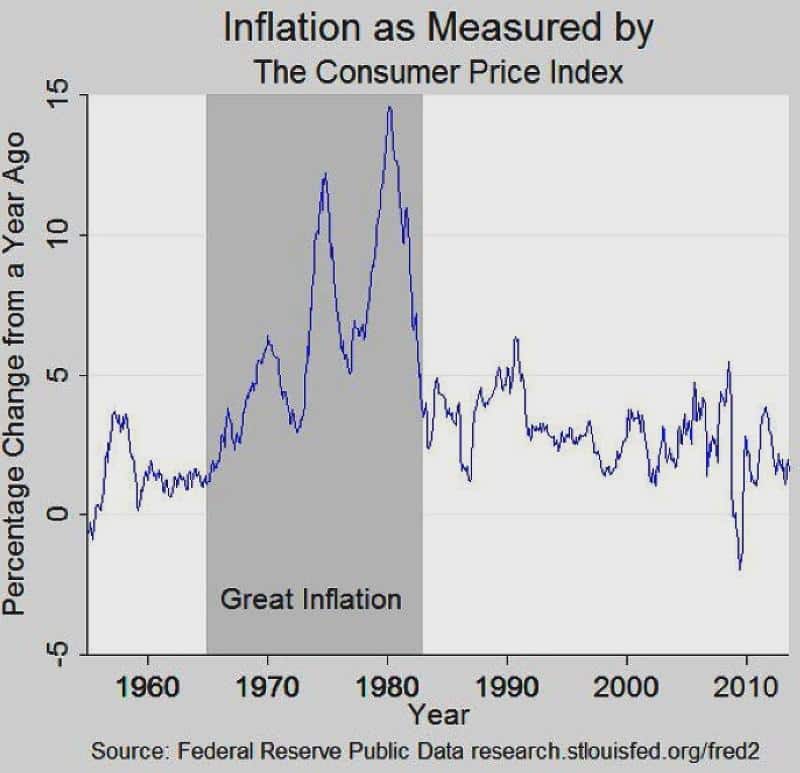

1955-2013 Inflation Chart Screenshot. Source-federalreservehistory.org

The last time U.S. inflation was running at more than 6% was back in the 1970s. That time it went up to 15%.

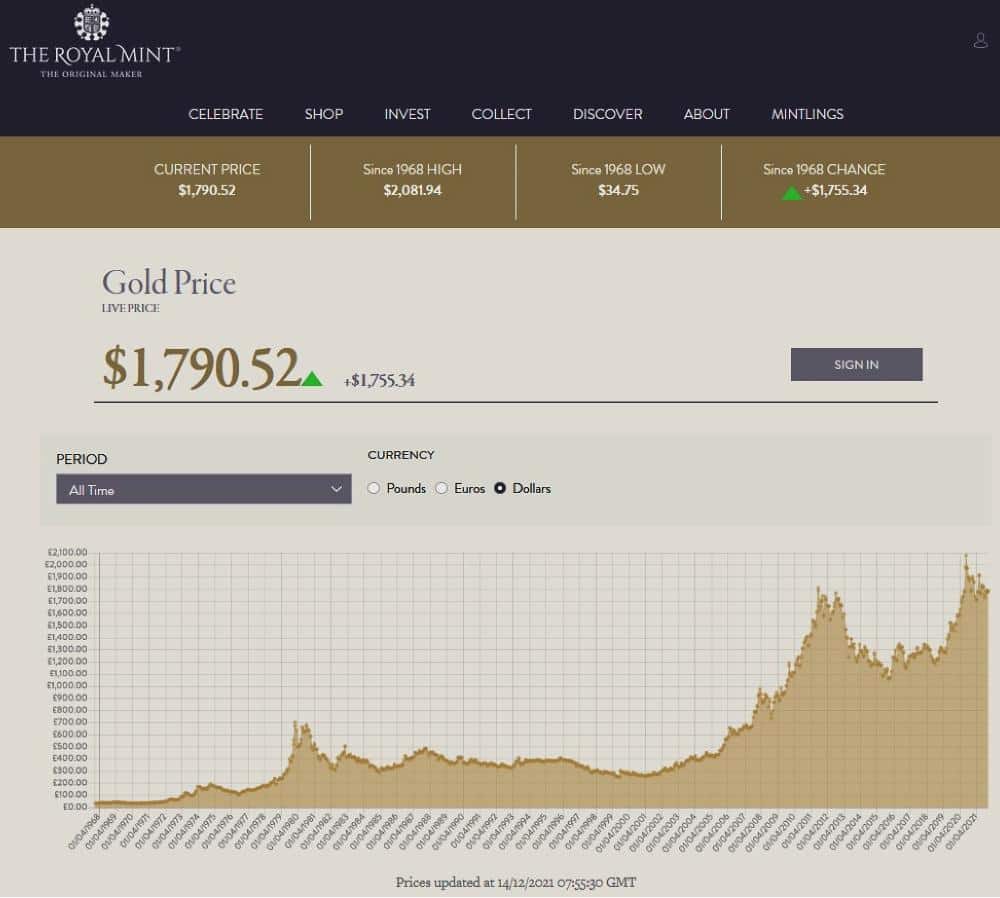

Should You Consider Gold?

Where do you put your money when inflation is high and interest rates are low? In the past, investors have put their money into precious metals. It might be time to think about gold, silver, and platinum right now.

Gold Prices 1968-2021 Screenshot. Source-The Royal Mint

The chart shows the price of gold jumped in the late 1970s when inflation was running at 15%.

Trading vs. Investing

If you are thinking of investing in precious metals for the long term, you should limit your investment to about 5% of your capital. This way, your exposure to any price crash would be limited. The rest of your capital could be earning you dividends through stock market investments. Sensible investing should help your savings keep pace with inflation.

Traders in precious metals try to make money from short-term price changes, sometimes buying and selling within a few minutes, and always the same business day.

Is Trading Precious Metals for You?

- Are you prepared to learn the skillset necessary? It will take you months rather than days.

- Are you ready to risk some of your capital? You will lose money at least part of the time.

- Do you have the time? If you treat trading as a part-time hobby, you will lose money.

Essentials to Start Trading

You must have an account with a trading platform. eToro is among the most well-known brokerages where you can trade gold commodities in the form of CFDs. The eToro gold trading hours are basically the same as with the regular trading hours of this precious metal (opens on Monday at 4pm and closes on Friday at 2:30pm). Accounts are free to open, but you will need to make a deposit before making any real-life trades.

Many traders use dedicated trading apps such as easyMarkets to trade from their phones. If you prefer a big screen you can use your laptop to place trades using the trader’s website.

Understanding the Precious Metals Market

Precious metal prices are volatile. It is this volatility that makes them attractive to traders.

The precious metals market consists of four metals; gold, silver, platinum, and palladium.

The gold and silver markets see many more trades than the platinum and palladium markets. New traders should focus on the gold and silver markets because the larger number of trades means the markets are less liable to sudden price changes caused by one large purchase or sale.

Gold

Gold is the most heavily traded, so new traders should investigate the gold market first. Gold is used in jewelry and electronics, but most price movements happen when investors decide to buy or sell.

Silver

Silver is used in jewelry and batteries as well as as an investment vehicle. Price changes depend on industrial and investor demand. Silver prices generally rise as gold does, so if you see gold prices rise, you might expect to see silver prices follow suit.

Silver traders often use the gold-silver ratio as a predictor of where silver prices might be headed. The gold-silver ratio is the number of times the spot price of silver will go into the spot price of gold. This is not a recommended indicator because it fluctuates widely and experts do not agree on where it should be

Platinum

Platinum jewelry is becoming popular, but most platinum is used in catalysts in industry and in car exhaust catalysts. It is used as an investment vehicle, but prices are largely determined by industrial demand.

Palladium

Palladium’s main use is in catalysts to replace the more expensive platinum. Price changes are driven by industry.

Starting Your Trading

Start by researching the gold market. Lock your wallet until you have completed at least three months of research.

Research contracts for difference (CFDs). When you take out a CFD you predict whether the price will rise or fall. If you are wrong you make a loss. If you are correct you can make a profit. You never own the gold or other commodity, and you must close the contract before the close of business.

Learn to read moving average and candlestick charts. Look for resistance levels (where prices peak) where traders sell and prevent the price from rising higher. Look for support levels (where prices reach a minimum) where traders buy because it’s too good a bargain to miss.

Learn about stop-loss and take-profit positions. Stop-loss positions automatically close your position if the price falls to a level you choose. You decide how much you can afford to lose and choose your stop-loss position accordingly. A take-profit position automatically closes your contract when the price rises to a level you decide is reasonable to expect.

Choose a trading platform that lets you set up a stop-loss position when you enter a contract.

Take out a paid trading advice subscription so you get the best advice available rather than relying on free tips from bloggers and newspapers.

Open a virtual trading account with your chosen platform. These are free and mean that your first losing trades are only pretend money. Stick with virtual trading until you are consistently making more good trades than bad ones.

Keep your trades small because that way, any losses you make will be smaller.

Be Humble

The market is always right.

No matter what your personal research shows, if it goes against the prevailing feeling in the market, you will lose money.

Recognize any tendency you have to make emotional decisions, ask for advice, AND take it.

Leave a Reply