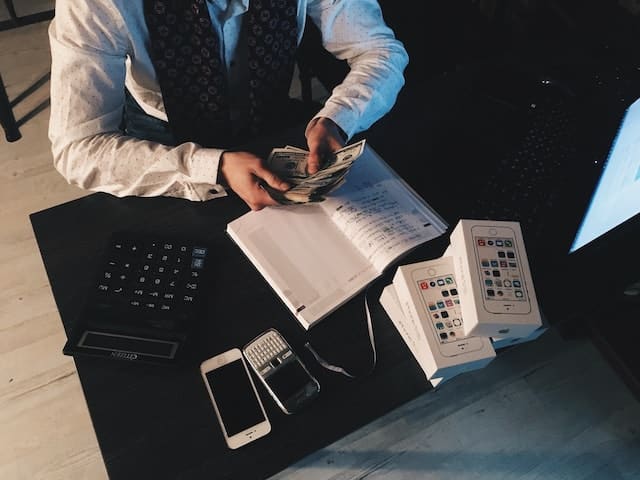

Cash flow management is crucial for contractors, as it ensures that their business runs smoothly and they can pay their bills on time. Unfortunately, many contractors struggle with cash flow management, which can lead to financial difficulties, including unpaid bills and even bankruptcy. In this article, we will discuss how accountants can help contractors with cash flow management.

Introduction

Contractors face many financial challenges, including managing their cash flow. This can be difficult for those who are not experienced in finance, accounting, or bookkeeping. Accountants can play a vital role in helping contractors manage their cash flow and avoid financial difficulties. In this article, we will explore how accountants can assist contractors in cash flow management.

Understanding Cash Flow

Before we dive into how best accountant for contractors in UK can help with cash flow management, it’s essential to understand cash flow. In simple terms, cash flow is the money coming in and going out of your business.

The Importance of Cash Flow Management

Managing your cash flow is essential for any business, including contractors. Cash flow management allows contractors to pay their bills on time, manage their expenses, and ensure that they have enough cash on hand to meet their financial obligations.

Common Cash Flow Problems Faced by Contractors

Contractors face many cash flow problems that can negatively impact their business. These include:

- Late payments from clients

- Unforeseen expenses

- Overdue bills and taxes

- Lack of financial planning and forecasting

How Accountants Can Help with Cash Flow Management

Accountants are important as they play a crucial role in helping contractors manage their cash flow. Here are some ways they can help:

1. Bookkeeping and Accounting Services

Accountants can provide bookkeeping and accounting services, which involve managing your financial records, transactions, and other financial information. They can also provide cash flow forecasting, which helps you plan and prepare for future financial needs.

2. Invoice Management

Accountants can assist with invoice management, ensuring that invoices are sent out on time, and payments are received promptly. This can help contractors avoid late payments and improve their cash flow.

3. Financial Planning and Analysis

Accountants can help contractors with financial planning and analysis. This includes creating budgets, forecasting cash flow, and identifying areas where expenses can be reduced. They can also provide advice on how to manage finances during slow periods.

4. Tax Planning and Compliance

Accountants can assist with tax planning and compliance, ensuring that contractors are meeting their tax obligations and taking advantage of any available tax breaks.

5. Outsourced CFO Services

Accountants can provide outsourced CFO services, which involve acting as a part-time CFO for your business. They can provide financial analysis, strategic planning, and overall financial management to help your business grow.

How can accountants help contractors with financial analysis?

Accountants can play a significant role in helping contractors with financial analysis. Financial analysis involves evaluating a company’s financial performance and using that information to make informed business decisions. Here are some ways that accountants can help contractors with financial analysis:

Assessing Financial Health

Accountants can evaluate a contractor’s financial health by analyzing financial statements, such as income statements, balance sheets, and cash flow statements. This analysis can help identify any financial weaknesses and areas where improvement is needed.

Creating Budgets

Accountants can help contractors create and maintain budgets, which are essential for managing expenses and forecasting future financial needs. They can analyze past financial data to create realistic budgets that align with the contractor’s business goals.

Analyzing Business Performance

Accountants can analyze a contractor’s financial performance to identify trends and areas where improvements can be made. This analysis can help contractors make informed decisions about their business, such as whether to invest in new equipment or hire additional staff.

Forecasting Cash Flow

Cash flow forecasting is an essential part of financial analysis. Accountants can use financial data to forecast a contractor’s cash flow, which can help them plan for future financial needs and avoid cash flow problems.

Providing Financial Advice

Accountants can provide financial advice to contractors on a range of issues, such as tax planning, financing options, and investment opportunities. This advice can help contractors make informed decisions about their business and finances.

Conclusion

Cash flow management is crucial for contractors, and accountants can play a vital role in helping contractors manage their cash flow effectively. From bookkeeping and accounting services to financial planning and analysis, accountants can provide contractors with the support they need to ensure that their business runs smoothly.

Leave a Reply