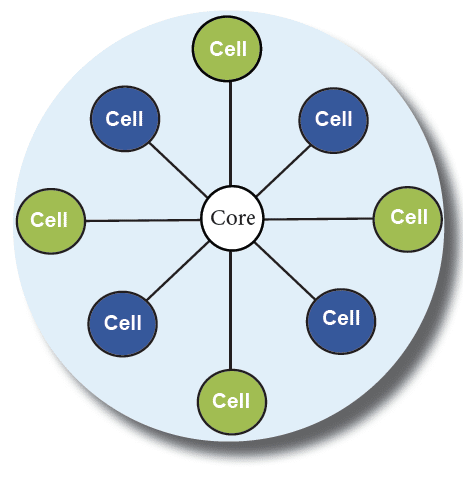

When it comes to insuring your business, it should be one less thing to worry about – not a trial within itself. Insurance is complex, it is tricky to negotiate, and it’s almost impossible to get the best deal. Added to this, there is a whole other side to insuring your business that you probably haven’t even considered and that’s cell captive insurance: where you underwrite yourself for insurance needs by setting up a firm (or ‘cell’) of your own.

We already know that you should choose Talisman Casualty Insurance Company when it comes to finding the best cell captive insurance available on the market. What we might not know is why cell captive insurance is such a good idea in the first place. To that end, we have researched the top five benefits of choosing a cell captive insurance company for your business.

Why Cell Captive Insurance Is Good for Business

Below, you will find the top 5 best reasons to opt in for a cell captive insurance firm like ours.

1 – Reduced Risk Management Budgeting

When you or your business are involved in particularly risky operations, you soon find that insurance premiums are especially high. This may seem like it is unfair, but it is actually good business on the part of the insurance firm. The higher the risk/liability that will cause harm to the public or to your workers, the more expensive the insurance is likely to be.

When you set up your own cell captive insurance company you can set your own premiums or can even bypass them altogether.

2 – Full Customization

When you run your own insurance firm to insure your business through cell captive programs, you have the ability to fully tailor the policy to meet your business’s needs. This is especially useful for firms with aspects that other insurers question. If you are working underground, for example, it might cost thousands in workers liability which you could save by operating through a cell captive insurance scheme.

3 – Keeping Costs Down

When you are able to charge your own firm for insurance premiums, you are the one that decides what the costs should be. Small businesses who have large fleets of vehicles, for example, are able to drop off thousands every year for their car premiums, should they put together a cell captive insurance strategy that works for them, not against them.

4 – Re-Insurance

One of the ways you can minimise your monthly insurance premium expenditure is by setting up a cell captive insurance program of your own. The reason this lowers your premiums so vastly is because you will gain access to re-insurance markets. This will provide you plenty of opportunity to lower those monthly costs, and to get on with business as usual!

5 – Uninsurable?

Those who can’t get insurance anywhere else on the market will always have somewhere to turn cell captive. They can set up their own firm able to insure their business, all using those re-insurance markets to get the best deals. Using this technique, you could go from having no insurance to having unlimited options, overnight.

Rounding Up

So what are you waiting for? Opt for cell captive and start reaping the benefits, ASAP.

Leave a Reply