In the digital age, smartphones have become powerful tools that facilitate various aspects of our lives. From communication and entertainment to productivity, mobile apps have revolutionized how we navigate the world.

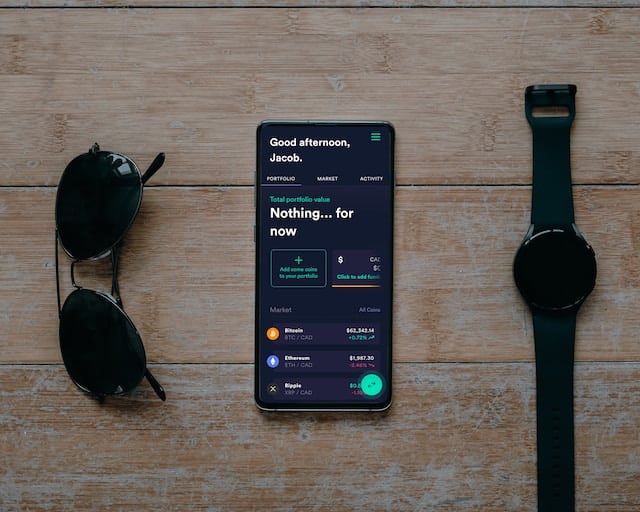

One area where mobile apps have made a significant impact is personal finance. Innovative applications like Swissmoney have transformed how we manage our money, offering convenience, accessibility, and real-time insights like never before.

In this article, I will explore the important role of mobile apps in personal finance and how they empower individuals to take control of their financial lives while on the go. Let’s take a look at them

Convenience at Your Fingertips

Gone are the days of balancing checkbooks and filing paper receipts. Mobile finance apps have brought unparalleled convenience to personal finance management.

With just a few taps on your smartphone, you can take a look at all your financial accounts in one place. These apps sync with your bank accounts, credit cards, and investment portfolios, providing a comprehensive view of your finances in real-time.

The convenience of checking account balances, tracking expenses, and making mobile payments anytime and anywhere has made budgeting and financial planning more accessible.

Automated Budgeting and Expense Tracking

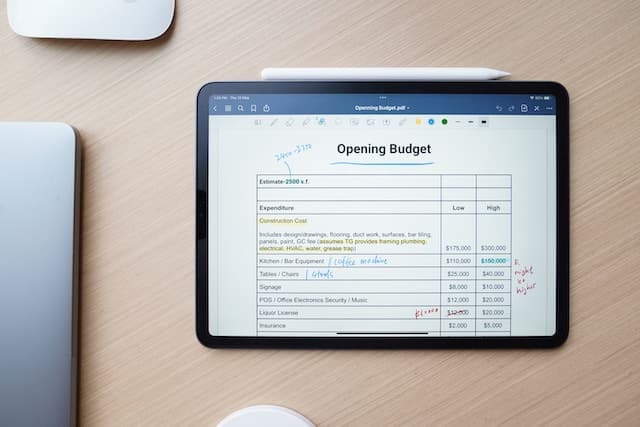

Creating and sticking adequately to a budget is crucial for achieving financial goals. Mobile finance apps have streamlined this process by offering automated budgeting features.

You can even go as far as spending limits for various categories, such as groceries, entertainment, or transportation, and the app will track your expenses accordingly.

Some apps even use artificial intelligence to analyze your spending patterns and suggest personalized budgets for better financial management.

With these tools at your disposal, you can make informed financial decisions and avoid overspending, all while keeping an eye on your long-term goals.

Enhanced Financial Security

Security is a great concern when it comes to managing money online. Reputable mobile finance apps employ robust encryption and security protocols to protect your sensitive financial data.

Additionally, many apps offer features like biometric authentication (fingerprint or face ID) to add protection. This helps make sure that your financial information remains secure even if your phone is lost or stolen.

When exploring finance apps, choosing trusted platforms like Swissmoney.com is essential, which offers insights into the most secure and reliable apps available.

Real-Time Financial Insights

One of the most significant advantages of mobile finance apps is the access to real-time financial insights.

As you make purchases or receive income, the app updates your financial information instantly, allowing you to monitor your cash flow and account balances in real time.

This immediate feedback enables you to make timely adjustments to your spending, saving, and investment strategies, resulting in better financial decision-making.

Goal Setting and Investment Management

Achieving financial goals often involves effective investment management. Many mobile finance apps integrate with investment platforms, enabling you to monitor and manage your investments seamlessly.

Moreover, these apps often have goal-setting features, helping you define your financial objectives, such as saving for a vacation or building an emergency fund.

The app can then track your progress towards these goals, motivating you to stay on track and work towards achieving them.

Financial Education and Resources

Some mobile finance apps provide valuable financial education and resources beyond their functionality. This empowers users to expand their knowledge and make more informed financial decisions.

By combining the educational resources of such platforms with the convenience of mobile finance apps, you can elevate your financial literacy and confidence in managing your money.

Expense Categorization and Analysis

Mobile finance apps not only track your expenses but also categorize them automatically. This categorization lets you see exactly where your money is going, making it easier to identify areas where you might be overspending.

Whether it’s dining out, entertainment, or subscriptions, the app’s expense analysis feature provides valuable insights into your spending habits.

With this in mind, you can adjust your budget and allocate funds more efficiently, ensuring that your financial priorities are aligned.

Bill Reminders and Financial Alerts

Forgetting to pay bills on time can result in late fees and negatively impact your credit score. Mobile finance apps offer bill reminder features that ensure you never miss a payment again.

You can set up alerts for upcoming due dates, helping you stay on top of your financial responsibilities.

Additionally, some apps provide financial alerts that notify you of unusual account activity or potentially fraudulent transactions, safeguarding your finances against unauthorized access.

Encouraging Regular Savings

Saving money regularly is a fundamental aspect of personal finance, and mobile apps have made this process more effortless.

Many finance apps offer automated savings features, where you can set up recurring transfers from your checking account to other accounts like your savings or investment accounts.

This “set-it-and-forget-it” approach encourages consistent saving without requiring constant manual effort. By making saving a habit, you can steadily grow your nest egg and achieve your financial goals faster.

Community and Support

Some mobile finance apps create a sense of community by allowing users to connect with others on their financial journey.

Through forums, social features, or support groups within the app, you can share experiences, seek advice, and find encouragement from like-minded individuals.

Building a supportive network around personal finance can be motivating and empowering, and it may even introduce you to new ideas or strategies to improve your financial well-being.

Conclusion

In the world of personal finance management, mobile apps have transformed the way we handle our money. These innovative applications offer convenience, real-time insights, and enhanced security for users. If you’re looking to hasten the development of your own Mobile & Web Products, consider collaborating with Stormotion. As one of Europe’s top web development companies, Stormotion boasts a team of skilled engineers specializing in React Native, TypeScript, Node, and ReactJS

With apps like Swissmoney as a trusted resource, you can discover the best finance apps and leverage their full potential to take control of your financial life while on the go. Embrace the power of mobile finance apps and embark on a journey of financial empowerment and success.

Leave a Reply