You have already heard of Bitcoin, Ethereum, Litecoin, Ripple, but do you really know their true meaning? If you don’t, you are not alone. Even in this 21st century, many people have yet to fully grasp what cryptocurrency is and how it works. So before you start beating yourself for not knowing these things, you need to know that there are many people out there like you.

But in this post, we will be helping to shine some light on this seemingly complicated topic; cryptocurrency. If that sounds interesting to you, then read on.

First, What is Cryptocurrency?

Initially designed as an instrument of exchange in the digital world, a cryptocurrency can be qualified as a virtual currency since it does not benefit from any physical or financial backing. It is an asset that is traded peer-to-peer, without a central body as an intermediary and is therefore not indexed to the dollar or gold.

These new electronic currencies are a secure means of exchanging money between different users thanks to a computer protocol called blockchain (ledger), which ensures the reliability and traceability of transactions.

How Does Cryptocurrency Work? What Is Blockchain?

The basic technology of cryptocurrency, the blockchain, is a kind of ledger on which everyone can freely write but where no one can erase. When a transaction is carried out between two individuals, it is recorded in a register encoded by a key. Several transactions are grouped in this register, which is called a “block.”

Several members of this decentralized system, the “miners” will then try to decipher the key of this “block”. For this, the “miners” must perform very complex calculations using computers. The first “miner” who succeeds in finding the key, unlocks the “block” and validates the operations contained therein.

Once validated, the “block” of operations is dated and added after the other blocks in the register in a permanent and immutable way. This system then creates a huge decentralized, secure and transparent blockchain database called the “blockchain”.

The majority of cryptocurrencies use blockchain technologies, even if other technologies can be added.

How Is A Cryptocurrency Created?

The process that underpins the operation of a cryptocurrency and ensures that transactions run smoothly is called “mining”. It is a process where cryptos are created by a group of internet users and members of the decentralized system. These people are called miners. They all work for a reward called tokens. These tokens are allocated to each “miner” who succeeds in deciphering a “block”, as a reward for his participation in the proper functioning of the system.

As we have seen previously, the verifier of the operation (the “miner”) must provide a kind of “proof of work” consisting in solving a mathematical problem. In exchange for this service, the miner receives a token. For Bitcoin, for example, the “miner” who succeeds in validating an operation block will receive a reward in the form of bitcoin.

Once created, these tokens are stored in an electronic safe. It is then possible to transfer them via the Internet and anonymously between members of the community.

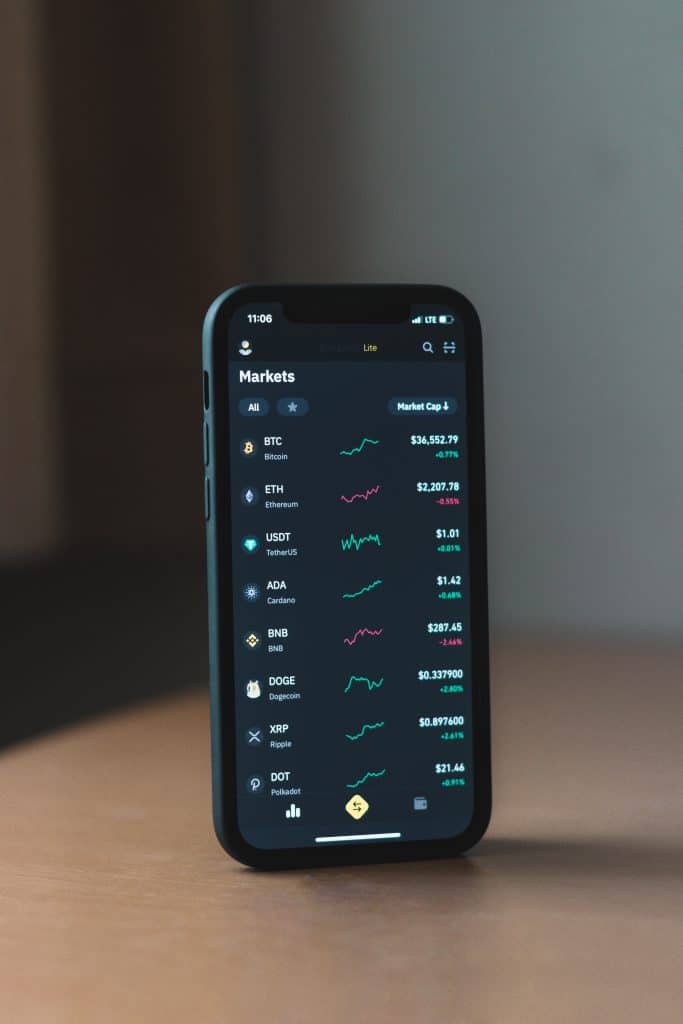

The Main Cryptocurrencies and Their Differences

In 2019, the Ministry of Economics and Finance counted 2871 crypto-currencies in circulation worldwide. There are, therefore, very many crypto-currencies, but only a few dozen can be called popular crypto-currencies.

The first cryptocurrency to emerge in 2009, and arguably the most famous of them all, is Bitcoin. Bitcoin can be considered the digital gold standard of the cryptocurrency market. It was created with the idea of a real digital currency. Moreover, certain goods can already be purchased in Bitcoin, and El Salvador is the first country to recognize Bitcoin as legal tender.

The other benchmark cryptocurrency is Ethereum. It is the second crypto (after Bitcoin) in terms of capitalization. Bitcoin and Ethereum share the characteristics inherent in most cryptocurrencies but serve entirely different purposes.

Ethereum is not a currency. It is a system created to develop decentralized blockchain applications based on “smart contracts”. These are contracts that rely on Blockchain technology to make their terms and the conditions of their execution unforgeable. These contracts are executed automatically once the decentralized system has verified the fulfillment of its conditions. Thus the “smart contracts” based on Ethereum could eliminate all the intermediaries which are today necessary for the validation of contracts of any kind.

The possible applications of the Ethereum protocol are multiple. Many use cases can be found, for example, in banks: the transactions that take place there must now be processed and validated by many employees to finally be recorded in internal registers. With “smart contracts,” this process would become superfluous: all transactions would be automatically executed as soon as the conditions were met and recorded directly on a central ledger. The monetary unit inside this system is Ether.

Ethereum is therefore much more than just an electronic currency like bitcoin. It is both a decentralized exchange protocol and a cryptocurrency.

There are multitudes of other cryptocurrencies: Binance Coin, Dogecoin, Litecoin, NEM, Monero, Stellar, or Iota, to name some of the most important (measured at their current capitalization).

What Is A Cryptocurrency Used For?

- Cryptocurrency as a currency and other applications

Crypto-currencies do not (yet) replace traditional currencies since it is not yet possible to buy all everyday goods with them.

However, some of them already allow the purchase of a certain number of goods and services in certain brands. Elon Musk, founder of Tesla, for example, announced in 2021 that it will be possible to buy a car in Bitcoin. Other companies, such as the American merchant site Overstock also accept payments in Bitcoin. However, the acceptance of Bitcoin as a means of payment remains far from being generalized for the moment.

Cryptocurrency like Bitcoin certainly has advantages (individual freedom, global currency, independence, transparency, security, etc.), but a major problem remains (among others): volatility. Indeed, all classic currencies (EUR, USD, GBP, etc.) have a price that goes up and down, but none is as volatile as Bitcoin.

Apart from the use as a currency of exchange and a means of payment, crypto-assets have many other applications: “smart contracts” (which we mentioned earlier) and NFTs.

- Cryptocurrency as an investment or financial asset

Failing to be a generalized means of payment, certain cryptocurrencies have today become financial assets prized by many investors, who see in them a currency of the future, but also enormous potential in terms of “smart contracts” and underlying technologies. This potential is further realized through platform products like Bybit Staking, which offer attractive staking rewards and diversified earning opportunities for cryptocurrency holders.

The cryptocurrency market has experienced a real boom in recent years. However, these are risky and highly volatile investments.

5 Risks Are Often Associated With Cryptocurrencies:

- Opacity of information

- Speculation and market volatility (impossible to determine the fair value of a bitcoin for example, the “exchanges” display an average price, no official price exists) can lead to potentially very significant financial losses.

- Hacking

- The absence of regulation by States or central banks presents a legal risk.

- Risk of money laundering, terrorist financing, and criminal activities linked to the anonymous nature of transactions.

How to Buy Cryptocurrencies and How to Sell Them?

There are four ways to exchange crypto-currencies:

#1: Crypto Exchanges

Cryptocurrency exchange platforms are similar to traditional stock exchanges, on which you can exchange a traditional currency (EUR, USD, etc.) for a cryptocurrency, or vice versa. Some platforms also offer the exchange of cryptocurrencies between them. The price at which cryptocurrency trades depends on supply and demand. Among the best-known “exchanges” are Binance, Coinbase, Kraken, Coinhouse, etc.

There are 3 main types of crypto exchange platforms: centralized exchange platform or CEX, decentralized or DEX and hybrid cryptocurrency exchanges. CEX functions similarly to traditional stock exchanges. The buyers and sellers come together and the exchange plays the role of a middle-man. However, in A DEX traders are in charge of transactions directly between sellers and buyers. If you want to merge the benefits of both centralized and decentralized exchanges, hybrid exchange platforms can be your choice.

#2: Neo-brokers

With the rise of cryptocurrencies, more and more Dutch brokers are integrating them into their offers. Be careful when choosing a broker because some platforms have unfriendly terms and conditions. Some popular Dutch brokers include:

- Anycoindirect

- eToro

- Bitpanda

- Coinbase

- Bity

- Bitonic

#3: Transactions in particular

As with any other currency, it is possible to transfer a cryptocurrency from one person to another. The only condition is that both people must own an electronic wallet (crypto wallet).

#4: Physical exchange

In some cities, some ATMs allow you to exchange cash for a cryptocurrency (mainly Bitcoin) or vice versa.

Conclusion

The cryptocurrency has become so big that learning about it will take more than reading one article. If you want to have expert knowledge of cryptocurrency, access more articles and other informative training materials on our website and the Internet.

Cryptos are taking over the traditional financial world, and only those who are adequately equipped will take full advantage of this financial revolution.

Leave a Reply